Understanding the UK House Prices: Long-Term Investment Strategies Over Short-Term Hype

Introduction:

The UK housing market is a perennial topic of discussion, speculation, and varying opinions. Recently, predictions about house prices booming have been dominating the headlines, but seasoned investors know better than to take these at face value.

This blog post delves into the intricacies of the UK housing market, offering insights on why long-term investment strategies are more beneficial than reacting to short-term fluctuations in house prices. For more insights, you can also download our free guide – UK Property Market Forecast 2024.

The Press and Property Predictions

The press often releases sensational headlines to attract attention, and house prices are no exception.

In recent months, predictions of a significant boom in UK house prices have been circulating. However, these predictions can shift dramatically in a short time. For instance, only six months ago, forecasts were predicting a 3% fall in house prices, yet now, they are anticipating a 2.5% rise.

This 5.5% swing highlights the volatility and unpredictability of short-term market forecasts.

The Importance of Independent Thinking

One of the key takeaways for investors is the importance of independent thinking. Relying solely on press reports and reacting impulsively can lead to poor investment decisions. Instead, investors should gather information, analyse it critically, and make informed decisions based on long-term trends and fundamental market principles.

The Fundamentals of the UK Housing Market

To understand the UK housing market, it is crucial to consider the basic economic principle of supply and demand. The UK faces a significant housing shortage due to its limited land availability and stringent building regulations.

The country welcomes approximately a million new residents each year, yet the rate of new housing construction does not keep pace with this population growth. This imbalance between supply and demand has created a persistent housing crisis.

The persistent housing shortage in the UK means that demand consistently outstrips supply, driving up house prices. This fundamental principle suggests that, despite short-term market fluctuations, property values are likely to continue rising over the long term. Investors who understand this dynamic can make informed decisions that capitalise on the enduring strength of the housing market.

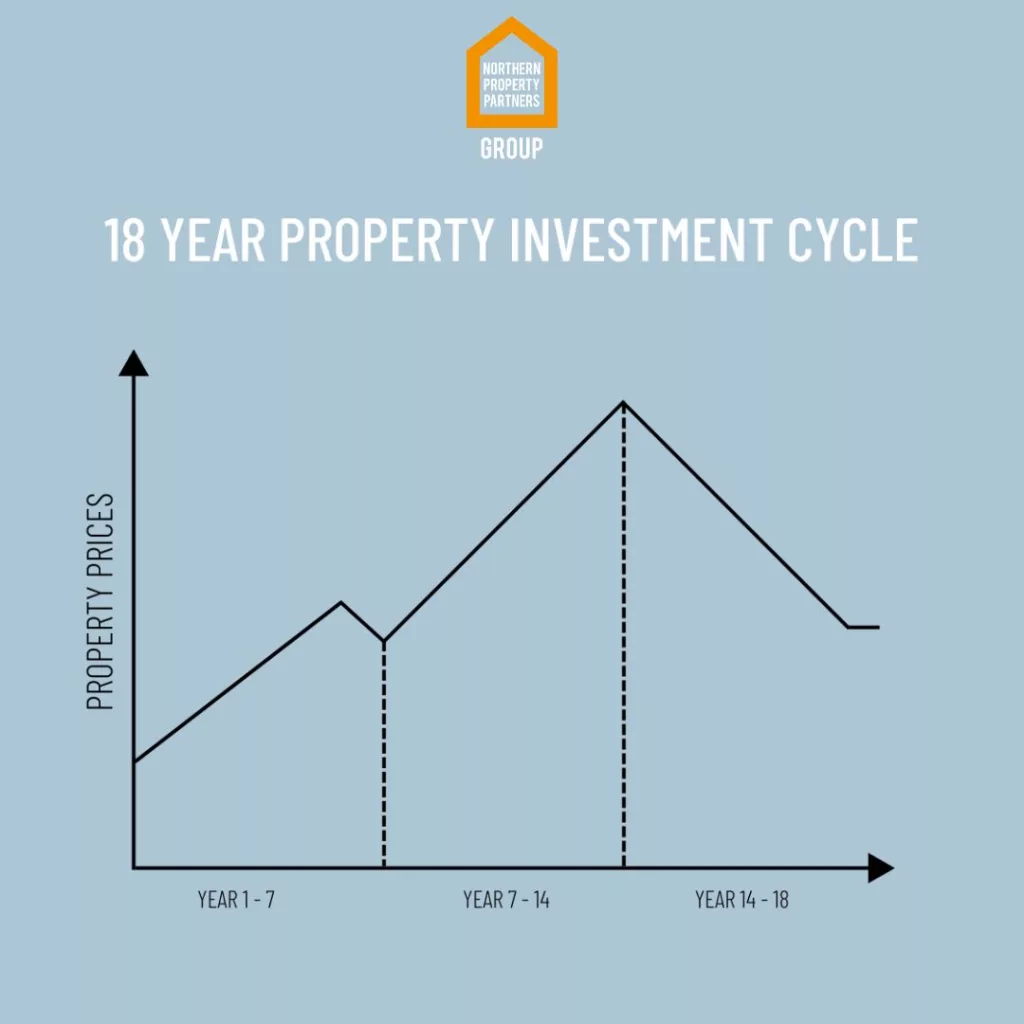

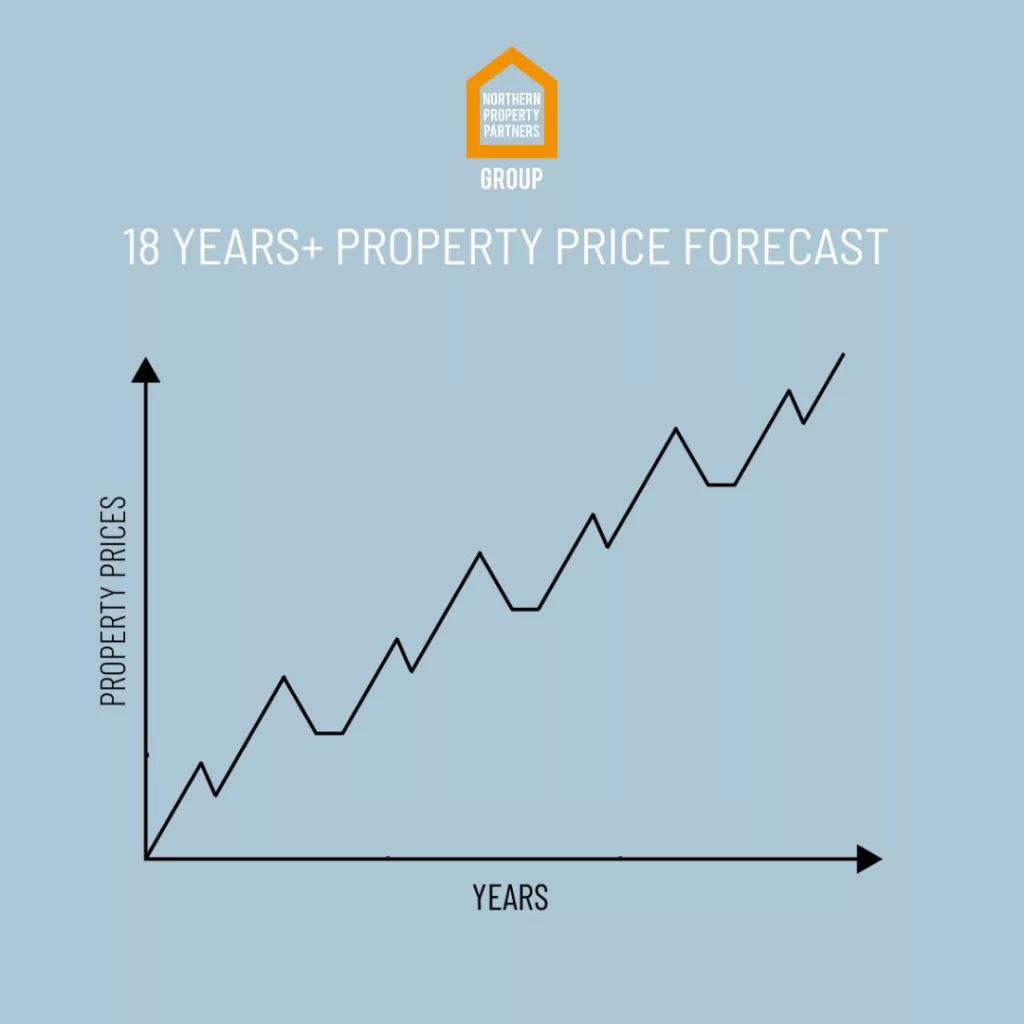

Historical Perspective: Long-Term Market Trends

Examining house prices over the past 50 years reveals a clear upward trajectory. Despite short-term fluctuations and occasional downturns, the long-term trend shows consistent growth. This historical perspective underscores the importance of focusing on long-term investment strategies rather than trying to time the market based on current headlines.

The Future of UK House Prices

Looking ahead, the UK housing market is likely to continue facing challenges related to supply and demand. The government’s efforts to increase housing supply may alleviate some pressure, but it is unlikely to fully address the underlying shortage. As a result, house prices are expected to maintain their long-term upward trend.

Long-Term Investment Strategies

For investors looking to build wealth in the UK property market, a long-term approach is essential. Here are several strategies to consider:

1. Buy and Hold: This classic strategy involves purchasing properties and holding onto them for an extended period. Over time, investors benefit from capital appreciation and rental income. This approach requires patience and a commitment to weathering short-term market volatility.

2. Diversification: Investing in different types of properties (e.g., residential, commercial, mixed-use) and in various locations can mitigate risks and enhance returns. Diversification helps protect against local market downturns and capitalises on growth in different sectors.

3. Leverage: Using mortgage financing to purchase properties allows investors to maximise their returns on investment. While leveraging increases potential returns, it also involves higher risk, so it is important to manage debt responsibly.

4. Renovation and Development: Adding value to properties through renovation or development projects can significantly increase their market value. This strategy requires a good understanding of the local market and construction costs but can yield substantial profits.

Conclusion: Think Long-Term for Sustainable Success

In conclusion, the UK housing market offers significant opportunities for investors who adopt a long-term perspective. While short-term market predictions and press headlines about house prices can be enticing, they are often unreliable and volatile. By focusing on long-term investment strategies, understanding the fundamentals of supply and demand, and avoiding common pitfalls, investors can build sustainable wealth in the UK property market.

Investing in property is a journey that requires patience, diligence, and a commitment to thinking independently. As the adage goes, “Time in the market beats timing the market.” By staying the course and making informed decisions based on long-term trends, investors can navigate the complexities of the UK housing market and achieve their financial goals.