The Hidden Tax and How to Beat it with Property

Blog By:

Jacob Ragan

Investment Specialist Northern Property Partners

Linkedin

Introduction:

When most of us think of the taxes we pay, we think of income tax on wages, corporation tax (if we are self-employed) or capital gains tax on our investments. On these known costs, people across the world will go to great lengths to reduce their liabilities.

However, there is one form of tax, that slips under the radar and attacks your earning and savings silently. This is inflation. You may be thinking that inflation isn’t a tax, but to understand why this could be classified as a tax, we need to understand what inflation means and the main reasons why it occurs. We need to understand this before we can look at the main strategies to defend against its silent attacks on your wealth.

We all know exactly how much tax we pay each year on our earnings or on the profits of assets as this is clearly stated and taken from us directly in front of us. We also know that the taxes taken go directly towards governments debt repayments and spending to keep the country going.

What is the main driver of inflation and what it means?

Inflation is often referred to as the rise in the prices of common goods, typically measured by the Consumer Price Index (CPI), which is a general basket of goods used to determine inflation changes and compare from year to year.

What most people do not realise is that inflation means a devaluation of your currency in comparison to the value of other assets and goods. It does not necessarily mean a price increase of goods like most people think. This is because we only track prices against this one variable (pound sterling). Granted, some short-term price fluctuation may be due to supply and demand. But over the long term, however, the main variable that drives inflation longer term is the amount of money supply and this money supply reducing in real value.

So Why Is This?

The government is in a lot of debt (as are the governments of most countries) and costs of running the countries and servicing their debts are increasing. The only way a government can keep up their payments are to either tax their country more, which wouldn’t be very popular, or to ask their central bank to print and loan them more money in return for an interest rate payment. When the government do this, they service their debts and fund the economy. This increases the countries money supply through a complex procedure called quantitive easing (the release of new money into the economy, thus increasing the money supply).

In short, more money has been created and the countries money supply has increased in line with the amount of money the government has borrowed and spent. As will supply and demand, if the supply increases and more of something is readily available, its value usually diminishes. This is exactly what happens to your money and savings through inflation. Effectively, the Bank of England creates money, the government borrows this money and thus directly affects the value of the money in the hands of its people. Hence why inflation could be seen as a hidden tax.

So How Do You Combat Against Inflation?

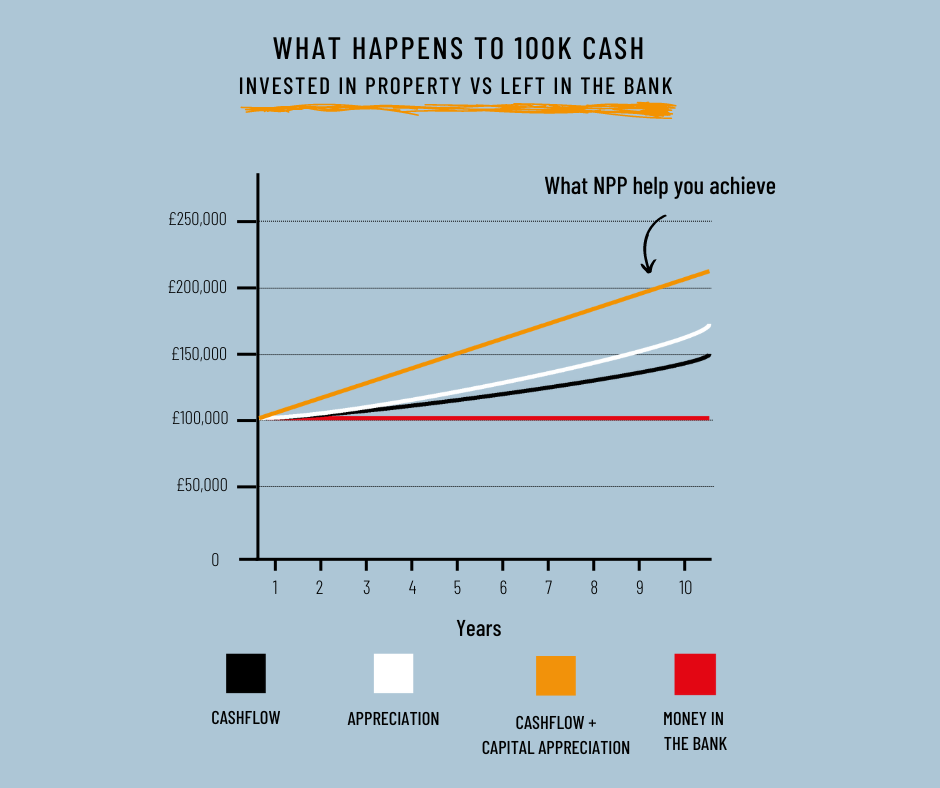

Unfortunately, inflation will affect the whole currency of a nation but the people hardest hit are those with savings on the bank. Viewed by most as the safest place to store money, what most people do not realise is the drastic affect that inflation has on their savings (graph below illustrates the reduction of purchasing power of money over time due to inflation)

So What Are Your Options?

For centuries, the savvy amongst us have realised that investing in assets can protect against the devaluation of currency. This is because if you were to look at the relative value of certain assets such as gold you would see that over time and in relation to other assets it seems to hold its value well and their price in the currency has increased dramatically. This is more down to the loss in purchasing power of a currency. However, gold has limited uses and is difficult to store. In our opinion, there are even better options.

Now let’s go one step further, the serious investors amongst us have realised that by investing in a leverageable asset such as property, not only will the asset hold its value against inflation as the property appreciates in value, but it will also:

- Pay a monthly cashflow profit meaning you can beat inflation, not just protect against it.

- Allow leverage so that an investor can put in a fraction of the property’s value yet have access to 100% of the property’s appreciation.

- Supply and demand. Supply of property is lower than the rate property demand is increasing. Thus, creating the right environment for property prices to outgrow inflation as when this newly created money from the government hits the economy, it tends to flow to assets in demand. This not only drives up property prices but also rental rates.

- Use inflation to their advantage. By using leverage, as the value of your savings reduce, so do the value of your debts. Whilst, I am not condoning all forms of debt, the use of a mortgage can be wise as not only does the asset used to purchase it increase in value, but it also pays a monthly cashflow profit and finally inflation will actually reduce the value of the debt over time.

To really visualise the points above. See the below graph:

Conclusion

Hopefully now we have armed you with a greater understanding as to why your money feels like it doesn’t stretch as far and show why the most tried and tested method of combating against it, is investing in property.

Northern Property Partners have helped hundreds of investors beat inflation and grow their wealth. If you would like to learn more, then book a call below.